Tax filers facing new challenges this year

Many taxpayers can expect to see some changes this year when they file taxes — mainly related to healthcare insurance and student expenses, said Accounting Professor Tamala Zolicoffer.

Many taxpayers can expect to see some changes this year when they file taxes — mainly related to healthcare insurance and student expenses, said Accounting Professor Tamala Zolicoffer.

“There are four situations you can be in,” she said.

The first, she said, is a person who had full coverage all year.

“Second, [those who] are exempt — and there are about 10 different exemptions.”

Those include being a member of a tribe, having an income below a certain level, or being on Medicaid, Zolicoffer said.

“Then there are the people who got their coverage through the marketplace, or government website, and those who didn’t apply or have any coverage.”

It’s the last two situations that everyone needs to pay particular attention to, she said.

“When the person applied for coverage … the government subsidizes those premiums.

“When those people applied [through the Affordable Care Act] they told the system what they thought their income was going to be for 2014, so what the government pays and the person pays was based on the income and size of the family that was reported.

“Then, based on their income on their tax return, it figures out if the government paid too much or not enough of their premium.

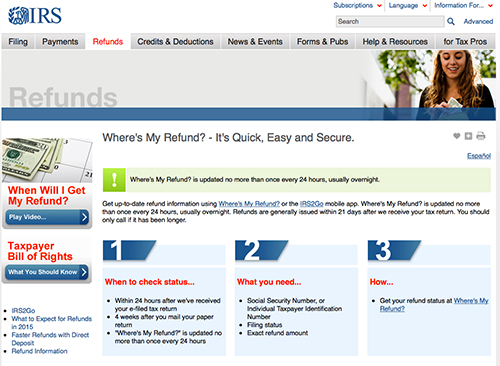

Visit www.irs.gov to find out the status of a federal tax refunds. There, learn if your tax return has been accepted, approved and payment sent.

“If the government paid too much, [that amount] gets added as a repayment on their tax bill,” Zolicoffer said. “If the government didn’t pay enough then it goes the other way and goes on their refund.”

She said for those who had elected to have no coverage, the amount they owe is calculated when they file for a tax penalty.

This tax season, Zolicoffer said, she’s seen penalties from $95 to $300. She said next year will be worse.

“The penalty is subject to change drastically,” Zolicoffer said.

“The minimum penalty next year will be $695 per person in your family. Apply immediately for [insurance for]next year.”

For students, Zolicoffer said, the American Opportunity Credit is still the same as in the past, but only applies for students in the first four years of school. Also, she said, tuition, books and supplies not covered by scholarships or grants can be used toward the education tax credit.

“The other education credit is the Lifetime Learning Credit — if you don’t qualify for the American Opportunity Credit.”

Zolicoffer said only tuition applies toward the Lifetime Learning Credit.

Zolicoffer said it is better if students have someone else prepare their tax returns.

“I always tell my students that it is worth it to have someone else prepare [their] taxes, and somebody reasonable, because the biggest thing that causes audits are errors — and when people prepare their own [taxes] the chance for errors is higher.”

She said having a tax preparer signature or an e-file lets the IRS know there’s a less chance of a return having an error.

She said the exception is someone who only has a W-2 and no other paperwork.

Students Cameron Langkamp and Katie Goodnight both did their taxes last year online using TurboTax.

“It is fast and easy,” Langkamp said. “It’s like plug and chug. You just put in the answers.”

Goodnight said her aunt helped her last year. This year, she also used TurboTax and agreed it was easy for her as well.

Rebecca Swihart, another OCCC student, went through H&R Block.

“They are expensive, but I have a peace of mind that if it goes wrong, they’ll be there if there’s a problem,” Swihart said.

Zolicoffer also recommends having a bank account when filing taxes.

“Everyone should have a bank account to get deposits,” she said. “They’ll get them a lot faster and safer.”

Zolicoffer said she spent five years as a tax preparer and more than 10 years with her own firm. She has been teaching full-time since August 2008.

The deadline to file taxes is Wednesday, April 15. For more information, contact Zolicoffer at 405-682-1611, ext. 7261, or tzolicoffer@occc.edu.

The Oklahoma City IRS office can be contacted between 8:30 a.m. and 4:30 p.m. Monday through Friday at 405-297-4057.Visit www.irs.gov/Filing for more information about what you’ll need to file.

To contact Katie Axtell, contact communitywriter@occc.edu