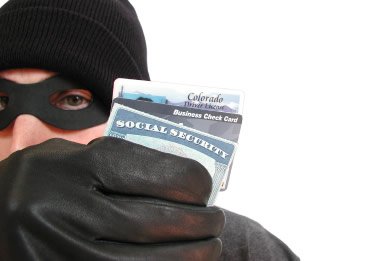

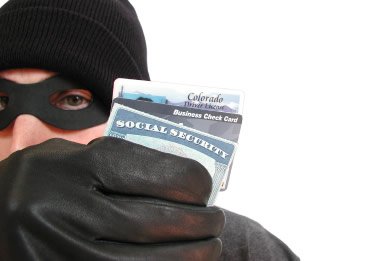

Identity theft occurs almost 700 times a day

A n identity was stolen roughly every two minutes in 2010. That’s a little more than 687 thefts a day, and 250,854 thefts over the course of the year.

n identity was stolen roughly every two minutes in 2010. That’s a little more than 687 thefts a day, and 250,854 thefts over the course of the year.

And, according to the Federal Trade Commission’s annual report, that’s just the number of times the crime was reported, not the number of times it was committed.

Identity theft is the illegal use of someone else’s personal information such as a Social Security number, in order to obtain money or credit.

Fortunately, there are steps that can and should be taken the moment a person realizes his or her identity has been stolen.

Immediately request a security freeze or fraud alert be placed on your credit reports.

A security freeze prevents anyone from accessing someone’s credit to take out loans or open new credit cards. In order to place a freeze, a consumer would need to contact each of the three major reporting agencies.

“It costs up to $10 to place, temporarily lift, or remove a security freeze,” says Kathi Rawls, managing partner of Rawls Law Offices.

“But it will stop the flood of your information being used wrongfully, and allow you to begin to clean up your credit and communicate with the individual vendors regarding access to your credit, and explain that this isn’t you.”

A fraud alert requires that any business opening new lines of credit in the victim’s name take reasonable precautions to ensure the person opening the credit line is not an identity thief.

A person only needs to contact one agency to place the alert. The other two will be notified and also place an alert on their copies of the report.

Liz Brandon, outreach coordinator for Oklahoma Money Matters, said it’s really about the level of inconvenience you can handle.

“The freeze [is] safer because no one can use your credit cards or information without lifting it, including you.”

Brandon said that doesn’t work for everyone.

“For some people that’s just not realistic because they need to use their own credit.”

Brandon said although a freeze or alert will stop new accounts from being opened, it won’t stop thieves from using accounts already created.

Consequently, victims must monitor for any fraudulent activity, even after placing a freeze or alert, by getting a copy of their credit report from all three reporting agencies.

“First thing, you need to assess the damage and find out what has been done with your information, in your name,” Brandon said. “Look for any addresses, accounts, names or other information you don’t recognize. Out of place information is a good indicator of fraudulent activity.”

According to the FTC, once an alert or freeze has been put in place, the account holder is entitled to a free credit report from each reporting agency.

File a police report. Specifically, file an Identity Theft Report, a special kind of police report that goes into more detail than a standard report, according to the FTC.

“A police report gives you credibility. Ten years down the line, someone might accuse you of using identity theft as an excuse to get out of a debt,” said Elaine Dodd, vice president of the fraud division of the Oklahoma Banker’s Association.

“Having that report shows that you were aware of the theft at the time of the report.”

File an investigation request. Also known as a Credit Agency Correction Request, this form requires the credit reporting agencies to investigate any activity you believe to be fraudulent, Rawls says.

“List the name of the business, account number, [and] any other information you have on the fraudulent usage.”

Rawls recommends sending the form by certified mail and requesting a return receipt.

“The agencies have 30 days to investigate the charges, beginning on the day you receive the receipt. Having that receipt ensures they can’t claim to have lost the request, and they will take prompt action.”

The form can be found at Rawls website, www.rawlslawoffice.com

Contact the businesses where affected accounts were opened or used.

Use the police report, credit report, and investigation request to prove possible identity theft, Brandon said.

“Check your credit report regularly and report to the police you’ve been working with if you see new activity. Close down affected accounts whenever possible and open new ones if you need to,” Brandon said. “Beyond that, just stay on it. Keep checking your credit report and alerting police of anything out of the ordinary.”

Document everything. Always keep a log of who you spoke to, what was said, and the date and time of the conversation. Brandon recommends buying a notebook for that specific purpose and updating it after every contact, while Rawls recommends her clients use paper forms and certified mail for documentation.

Finally, Rawls, Brandon and Dodd agree that recovering from identity theft takes time.

“You have to keep checking, especially once you think you’re done,” Brandon said.

“Even after you’ve closed an account, and done the work, and gotten the charges cleared off your credit, you absolutely must follow up regularly to make sure the thief isn’t still using your information.”

For more resources, go to www.ftc.gov/identitytheft.