Students say Higher One fond of fees

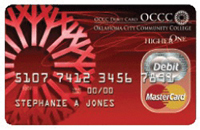

When OCCC began offering students a way to get their financial aid and loan money more quickly through a company called Higher One, the expectations were high.

Almost four years later, many students say the company has gotten out of control regarding the fees it charges, making them feel that perhaps it isn’t such a great thing after all.

Acting Bursar Cynthia Gary said Higher One accounts serve many purposes — one is acting as a refund program.

“If students receive a refund on their student account, it will go on [their] Higher One card,” Gary said. “It’s not just for loans, but also for overpayment for any reason — unless they’ve paid with a credit card. In that case the refund will go back on the credit card,” she said.

“If someone paid cash and dropped their classes we’re not going to give them cash back. It will go on the card. We don’t issue any type of refunds in this office.”

Most students interviewed said they think the fees are high. Higher One charges a fee if you use pin number for purchases.

“We don’t have checks and I’m charged fees each time I use it,” said Mary Brenn-foerder, photography major.

“The 50 cent PIN fee stinks. Students just don’t read the insert but that doesn’t make it OK,” said Natasha Russell, sociology major.

When compared with other financial institution’s debit MasterCard program, such as IBC or Midfirst, the funds availability and fee structure of HigherOne are similar.

“I don’t like the customer service,” said Cailyn Atkinson, Sociology and Forensic Science major.

“It took forever to get a live person, but if a student overpays on a class it’s a quick refund process to the card. It happened to me.”

This can be helpful to students that don’t have access to a financial institution.

“A lot of students don’t have bank accounts,” Gary said.

“They can spend it at the bookstore and they can get gas.”

Gary said the use of a Higher One card helps prepare students for the future.

“This gets students used to the process. When they move onto other institutions like University of Central Oklahoma, they will get a Bronco card.” she said.

“So we’re putting them ahead of the game with this type of electronic medium.”

Some students said there shouldn’t be as many fees. “I don’t like the fees,” said Nikki McKeil, nursing major.

Jude Floyd, Theater Arts major, said he agreed.

“There are too many fees and they should just give us one big check,” Floyd said.

Franklin Martinez, pre-engineering major, said he likes the program. “I have my own bank so it’s not a problem,” he said.

For students with a bank account, they can opt to have their refunds directly deposited into their bank account rather than HigherOne, according to the HigherOne website.

“I like the program and enjoy the benefits,” said JR. Rogers, music production major.

Gary pointed out some aspects of student life that can affect the bottom line.

“So many of our students move so often that our level of return mail is high, and if we were mailing out checks… it’s hard enough to get these cards into their hands. It’s a cost saving measure for the college and a security measure for them,” Gary said.

“If it’s lost and they haven’t activated it, we charge $10, but if it’s been activated, then lost, it will cost $20. The first one is provided at no cost,” Gary said.

The Higher One brochure provides much of the necessary information at student’s fingertips.

One of the nice features of the program is that students could setup online bill pay, receive detailed online statements or receive mobile alerts and it doesn’t require a minimum balance.

Students can use either of the two kiosks on campus with no fee. One is in the east entrance of the library and the other one is located near the entrance of the Main Building.

For more information about HigherOne and their services, go to occcdebitcard.com.

To contact Yvonne Alex, email staffwriter3@occc.edu.